Everything You Need to Know About Rental Property Depreciation

Owning a rental property can provide numerous financial advantages. It offers the potential for recurring income while the property appreciates over time. It also provides various tax benefits, including deducting operating expenses, mortgage interest and depreciation.

In fact, depreciation can significantly decrease the taxes owed on the income your rental property generates. It may even place you in a lower tax bracket. Let's look at how this tax benefit can help you keep more of your money at tax time.

What is rental property depreciation?

Depreciation is an accounting method that lets you write off the wear and tear your rental property experiences over time. Keep in mind that only the physical structure deteriorates, not the land. Therefore, you cannot depreciate the land value. This includes the costs associated with landscaping.

How do you meet the IRS requirements for depreciating a rental property?

According to the IRS, there are several requirements you must meet to take advantage of this tax break:

- You must own the property. Having a mortgage does not disqualify you.

- The property generates income, usually in the form of rent.

- The property's "useful life" must be determinable. Currently, a residential rental property's useful life is 27.5 years, according to the IRS. Commercial property's useful life extends to 39 years.

- The property's useful life is more than one year.

Fix-and-flip real estate investors cannot claim depreciation. This is because the IRS considers houses in this business model inventory, not investment property.

Why are landlords concerned about depreciation?

Depreciation offers significant savings. For instance, when you first purchase the property, you may incur the costs of repairs and finding a new tenant. These deductions, along with depreciation, may eliminate any taxes due.

Conversely, when you sell your rental property, any accumulated depreciation is recaptured and becomes taxable income. To defer these tax payments and capital gains, many real estate investors conduct a 1031 exchange.

This transaction, also called a like-kind exchange, lets you reinvest the sale proceeds into another property as long as it's "like kind." This exchange can be complicated and often requires the expertise of a CPA or tax attorney.

When does depreciation start?

Depreciation starts when you place your property in service or make it available for renters. For example, you buy your rental property on March 1 and begin renovations. By May 1, you're ready to rent it out. Your depreciation starts on May 1, even if it takes a while to find renters.

If your property sits idle after a tenant leaves, you can continue to depreciate it while you make repairs or search for the right renters.

How can you use depreciation to your advantage when filing taxes?

Currently, residential rental properties are depreciated at a rate of 3.636% each year for 27.5 years. This comes out to 100%.

For example, let's say you bought a rental property for $300,000. You can use the fair market value at the time of the purchase to determine the value of the building and the value of the land. (Remember, you can only depreciate the cost of the building).

You determine the cost basis or value of the house to be $270,000. $270,000/ 27.5 = $9,818, the amount you can deduct from your rental income every year.

Factor in any value-adds or losses

Of course, as with most tax laws, it can get confusing. For instance, you may have increased the value if you made improvements to the property before you placed it into service. Likewise, the value can decrease due to theft or damage.

You can also add qualified closing costs to the property value. These may include property taxes, installing utility services, transfer taxes and title insurance. Due to changing laws and complications, it's best to work with a qualified tax accountant. For those striking out on their own, you can file IRS Form 4562 to claim your depreciation deduction.

Landlords can also depreciate other items, such as furniture, appliances and carpet, which depreciate over five years. Fences and roofs have a 15-year depreciation period.

How does depreciation work in a partial year?

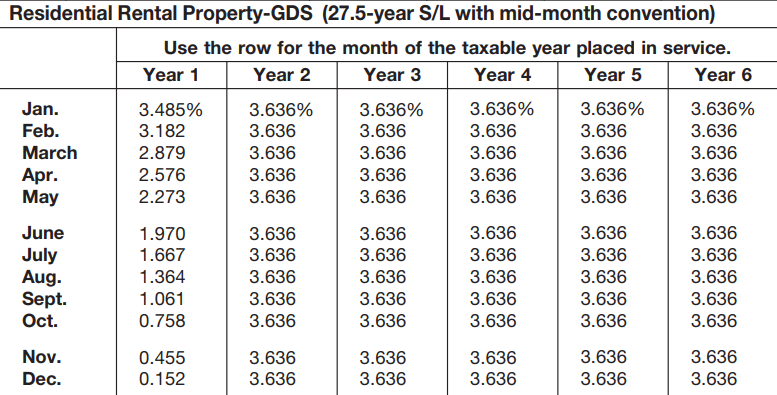

If you put your property into service in the middle of the year, the following table from the IRS can help you determine the percentage you can depreciate.

This table illustrates that if your rental property went into service in August, you would depreciate 1.364% the first year. The full 3.636% would apply to every year after.

What happens if you don't claim depreciation?

Rental property depreciation can provide a tremendous tax advantage. It's designed to offset the cost of maintenance and reduce taxable income.

If you've been doing your own taxes and failed to claim this deduction, you can amend your tax return and receive this benefit.

What are GDS and ADS in depreciation?

The Modified Accelerated Cost Recovery System (MACRS) is the accounting technique used to determine depreciation in residential rental properties placed in service after 1986. The General Depreciation System (GDS) and the Alternative Depreciation System (ADS) are the two MACRS techniques.

Here, we've covered GDS depreciation, as it is the most common method. Real estate investors use ADS on rare occasions, such as for a property with tax-exempt use or financed by tax-exempt bonds. Properties used for business 50% of the time or less and those used in farming also require this method.

Rental property depreciation decoded

As with most tax laws, ensuring an accurate calculation of a rental property's depreciation can be complicated. For this reason, many real estate investors turn to a tax professional when it's time to file.