11 Ways Your Renters Can Show Proof of Income

No matter how much you believe any prospective tenant is a good fit for your rental property, the most important question to ask yourself is, “Can they afford monthly rent payments?" While the jury is still out on the best breakdown of one's finances in relation to renting (see below), you have to verify proof of income to determine if it's steady enough for monthly rent.

Requiring proof of income is essential to the rental application process, and there are many ways to confirm it.

Expectations for rent

Proof of a tenant's income goes a long way in determining if they can afford monthly rent payments. Using one of these formulas could help verify income.

The 30 percent rule

The most commonly accepted equation for calculating the amount of rent a person can afford is the 30 percent rule. This rule says a person's income must equal three times the amount of rent.

The 50/30/20 rule

This strategy has people budget their money by breaking it into three categories — needs, wants and savings. Using this rule, 50 percent of a person's after-tax, monthly income goes to the things you need to pay, like rent and groceries. Thirty percent goes toward what you want to do, like eat at restaurants, and 20 percent goes into savings or to pay down debt.

What is proof of income?

To evaluate a person's earnings, ask for these various types of proof of income.

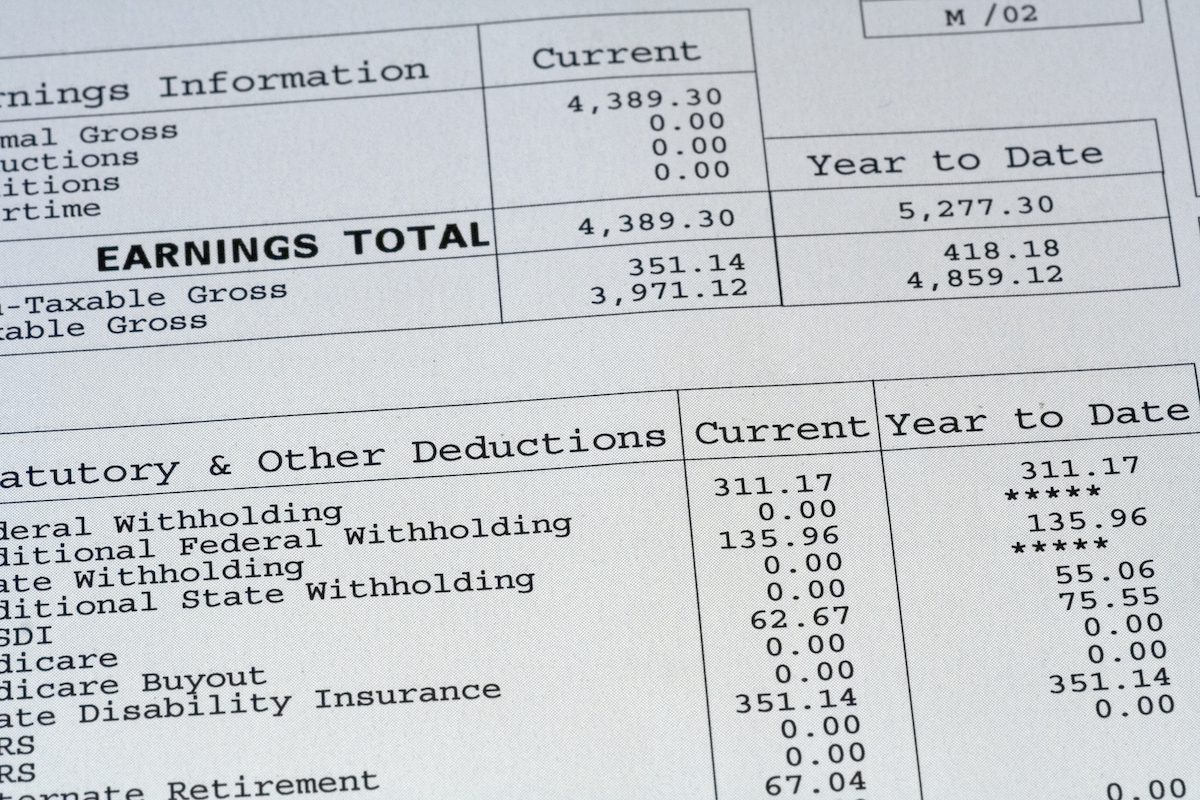

1. Pay stubs

If the renter is currently employed, a pay stub is an ideal source of proof of steady income. Not only do they show income coming in, but also the pay period and amount.

Ask for the most recent three months of a prospective tenant's pay stubs. You want to see the money that came in yesterday and last month, not last year. This is an up-to-date picture of what's happening now.

2. Employer verification

If it's challenging for the tenant to provide you with the paper documentation you need to verify employment, ask for their employer's email or phone number. You can contact them directly to verify that the applicant is bringing in steady income.

Identify yourself to the tenant's employer, and verify the tenant's salary and employment status. If this information is coming via a letter, it should contain an actual signature from the employer along with your tenant's:

- Current employment status

- Start date

- Job title

- Monthly salary

Make sure you have the company name and their contact information, as well. If the letter arrives on official letterhead, even better.

3. W-2/1099

There are two different types of tax forms — based on who employs your tenant — that show an income record for the entire previous year. A W-2 tax form is for those who have an employer and should match the total amount of all pay stubs for the year. While many people only have a W-2 from one employer, it's possible they could have more than one.

A 1099 form is technically for miscellaneous income, but it's used by many individuals who are self-employed and don't receive a pay stub. Like a W-2, it shows annual income. If a prospective renter mentions they are self-employed, ask them for all their 1099s. Most people who work for themselves usually have more than one since they often have multiple clients.

Ask for a profit and loss statement

For self-employed individuals, a profit and loss statement is another source of income that could be used to evaluate their overall financial picture.

4. Tax returns

A tenant's tax return has everything in it you need to confirm all incoming money. Tax returns list work income, child support, alimony payments, retirement funds, dividends, distributions, bank interest and more. Ask for the last year's federal tax return as part of the income documents.

5. Bank statements

Another source of income documents is bank statements. Again, ask for statements from the past three months. This not only provides excellent proof of income, but it also shows from where the funds originated.

When reviewing a bank statement, ignore all expenses. What concerns you most is whether the funds are present to cover rent, not that this particular tenant likes to order delivery three nights a week.

6. Annuity statement

An annuity is a financial product from an insurance company wherein a person receives a fixed payment for either their lifetime or a set period of time. You'll easily be able to confirm the time frame and exact payout for an annuity to establish how this plays into the overall proof of income for the prospective tenant.

7. Pension distribution statement

Checking a pension statement can be done when reviewing last year's tax return. The 1099-R includes retirement benefits like pensions, so you can confirm this specific source of income.

However, pensions can vary their distribution amount and things can change. If this is a tenant's sole source of income, it's worthwhile to check it again should they want to renew their lease for another year.

8. Interest and dividend income

Another income stream verifiable by its own tax forms, interest and dividend information is also on a person's tax return. Interest pops up on a 1099-INT and dividends on a 1099-DIV.

These income streams often provide a great source of supplemental income, adding to others you can review. It could be the extra sum that makes a renter perfect for your property, but it's often not enough to cover monthly costs.

9. Severance and unemployment documentation

For someone not currently employed, but not of retirement age, proof of income may come by way of one of these documents. Both show any income coming in related to their previous job.

A severance statement will share the details of a severance package given to the tenant if they're terminated from a job. This money is either awarded in a single lump sum or paid out in the same way they received paychecks. The latter form makes it easier to anticipate monthly income, while the former is dependent on how well the tenant budgets.

Unemployment documentation shows government payouts related to job loss. This is only a temporary source of income, so make sure unemployment benefits won't expire sooner rather than later. You wouldn't want to bring in a tenant only to have them run out of money to pay rent before the lease ends.

10. Worker's compensation letter

If a tenant isn't working due to an injury, their income most likely comes from worker's compensation. This is another temporary source of income, but it's easy to verify and means regular payments at regular intervals.

11. Social security benefits statement

When proof of income comes from a government document, you always know you're working with a reliable source. For tenants that are no longer working and are 62 or older, social security may be their primary source of income. This document will break down how much in monthly payments they get.

Even if social security is only supplementary for your tenant right now, it's part of their income and is something you should factor into their finances when reviewing everything.

If proof of income leaves you concerned

When everything else looks good, but you're a little concerned about a prospective tenant's income, don't feel like you have to reject their application. You can, but if they come so close you think it could work, there are some safeguards you can put into place to protect your bottom line.

These include requiring the tenant to bring in a co-signer. This means a responsible party, with the right finances, agrees to pay the rent for the tenant if they fail to do so. You can also charge late fees for late rent or request a larger deposit at the time they sign the lease.

Even with some extra protection in place, there's never any guarantee you'll always get rent on time, so be clear of all the consequences of a late payment — and what constitutes late — in your lease.

Spot the fakers

While most sources that prove income are from government tax forms and official documents, it's still possible for tenants to fake them. Make sure you know how to spot the fakers by using these tips:

- Get federal tax return documents directly from the IRS. The prospective tenants just have to sign Form 4506.

- Compare the monthly payout on pay stubs to the year-to-date income that should also be listed. It should add up.

- Check the ongoing balance on bank statements. It will change if extra deposits get added to the list.

- Verify self-employment by looking up their business online.

You should also not ignore your gut when screening potential tenants. If they hand you all their paperwork and something still doesn't add up, they're not the right tenant for you.

Screen carefully to find the right fit

As a landlord, it's up to you to carefully look at each prospective tenant to find the right one to pay rent. This means more than just getting to know them a little as a person. You have to dig deeper.

From credit checks to proof of income, you want to know as much as you can about a prospective renter. It protects you and your rental property while ensuring those rent checks come in on time and in full.