The Best Cities to Own a Rental Property

Where are the best cities for rental properties? That's the first question you should ask yourself if you're planning to invest in a rental home. Location is critical to your success as a property owner.

Choosing a place with reasonably priced homes, high rent costs and strong demand for rental homes will yield the best return on investment. To help you narrow down where to look, we've rounded up the best cities for rental properties and ranked them based on the potential cash-on-cash return, or the ratio between earned income and cash invested in a single-family home.

Finding the best cities for rental properties

Most of the metros that made our list have median home sale prices around or less than the national average of $353,000, according to the National Association of Realtors. In these locations, rent prices are mostly higher than the average price of $1,840, according to Redfin. Almost all the metros on our list have property taxes lower than $2,400, which is the average that most homeowners pay. Owning a rental property in these areas will cost you about $1,500 per year. Here are the 10 best cities for rental properties:

10. Palm Bay, FL

This beach city located about 70 miles from Orlando is a great place to live and continues to attract new residents. The weather is warm year-round and it's home to top-ranked schools and tons of lush parks offering outdoor activities like kayaking, cycling and nature trails.

Homes in Palm Bay sell for around $304,700, and you can rent them out for about $1,900. So, you could collect about $23,900 a year and your expenses, including mortgage payments and taxes, would total $16,100. That's a decent return.

9. Detroit, MI

Detroit has long been a hotbed of innovation as the home of the auto industry. But recently, it's transitioning into a tech hub that's popular with millennials. There's also a lot to do in the city, from attending professional sports games to visiting casinos to enjoying one of the many arts and culture activities.

Home prices in Detroit are well below the national average, too, which makes it a great place to invest in rental property. You can snag a home for about $181,800 and earn around $1,760 in rent each month. Over a year, you'll collect more than $21,000 in rent, with expenses averaging $17,000.

8. Homosassa Springs, FL

Located on Florida's west coast, Homosassa Springs is best-known for its wildlife state park with manatees, whooping cranes, red wolves and alligators. Residents enjoy a low cost of living, mild winters and quiet neighborhoods.

It's one of the best cities for rental properties. Home prices average $247,000 and rent prices are about $1,230. In a year, you'll earn more than $14,700 with expenses hovering around $12,000.

7. Lakeland, FL

Named for its dozens of lakes, Lakeland offers a quiet, small-town vibe, but big-city attractions are nearby. It's located between Tampa and Orlando and about an hour's drive from the beach. There's plenty to do in Lakeland, as well, including parks, trails and golf courses.

You can rent out your home for about $1,720 a month, totaling $20,725 a year. Expect to pay about $15,000 in expenses annually. That'll net you almost $5,000 in income. Plus, homes cost well below the national average at $250,000.

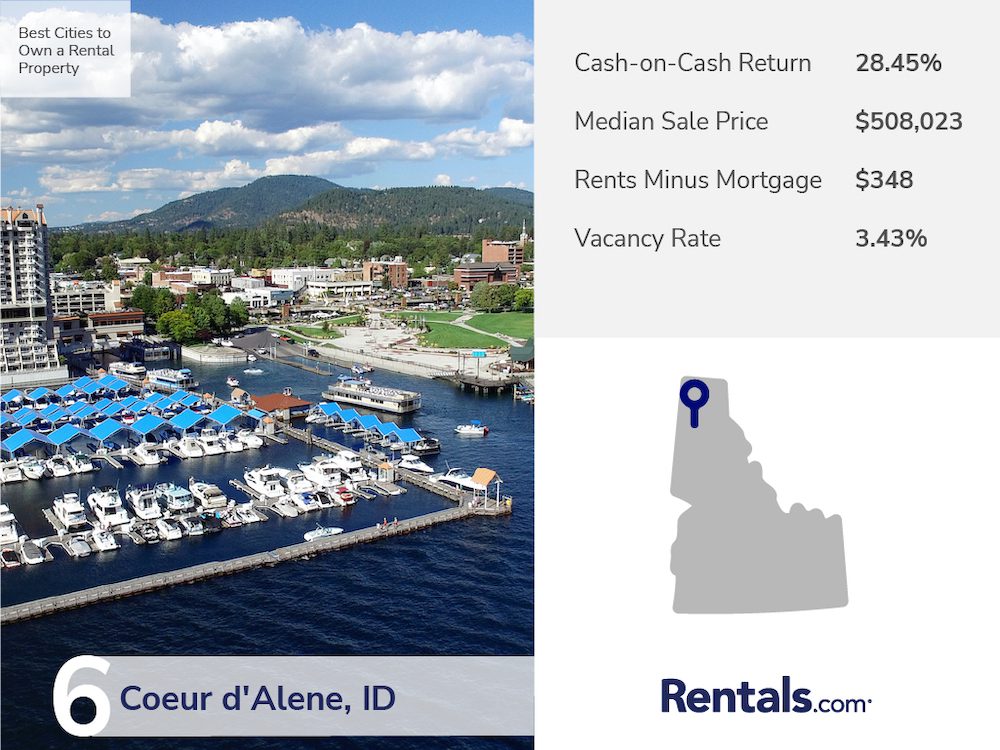

6. Coeur d'Alene, ID

Coeur d'Alene in northwestern Idaho has seen a population surge in recent years. So, snapping up a home to rent would be an excellent long-term investment. The city is just 30 miles from Spokane, WA, and a short drive from ski resorts. It's also home to the stunning view of Lake Coeur d'Alene.

Buying a home in Coeur d'Alene is pricier than in other areas at $508,000, on average. But, you can charge upwards of $2,200 a month for rent and you'll have no trouble finding tenants. This will earn you $26,306 a year and after paying out $16,500 in expenses, that's a hefty profit.

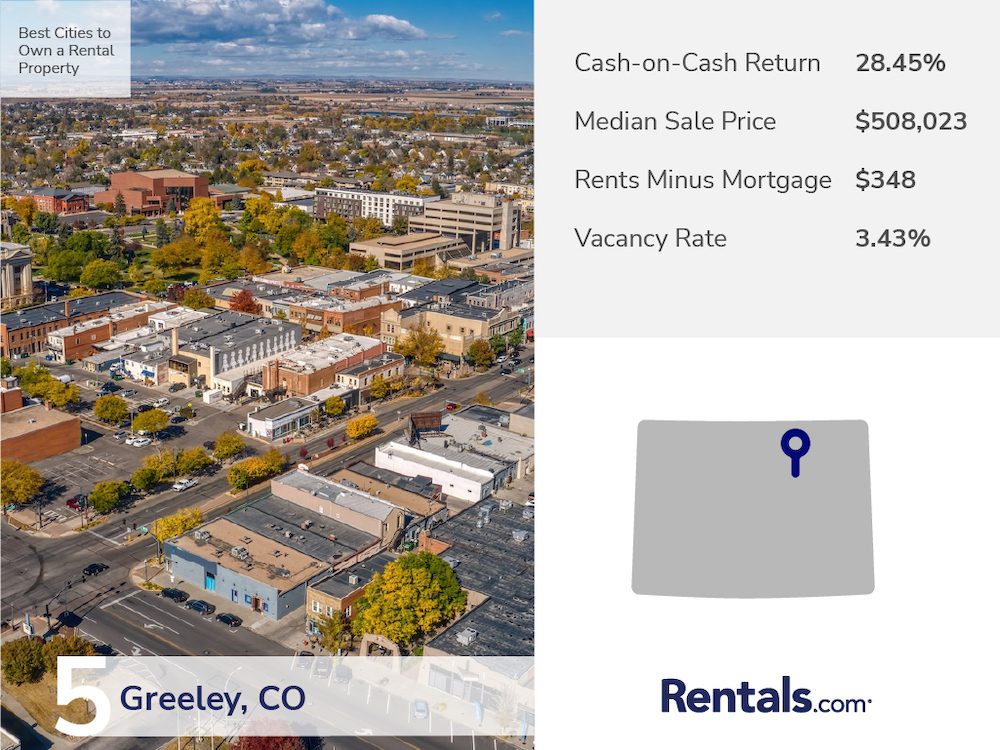

5. Greeley, CO

Greeley is a great place for renters. It's affordable, located just 50 miles from Denver, boasts stunning views and is home to tons of outdoor activities. Top ski resorts are nearby, too. So, you'll have no trouble keeping your home rented.

Even though homes are slightly more expensive in Greeley, averaging $443,800, you can charge more than $2,100 for rent. Each year, you'll bring in $26,306 and pay about $21,720 in expenses, so owning a rental property here is a worthwhile investment.

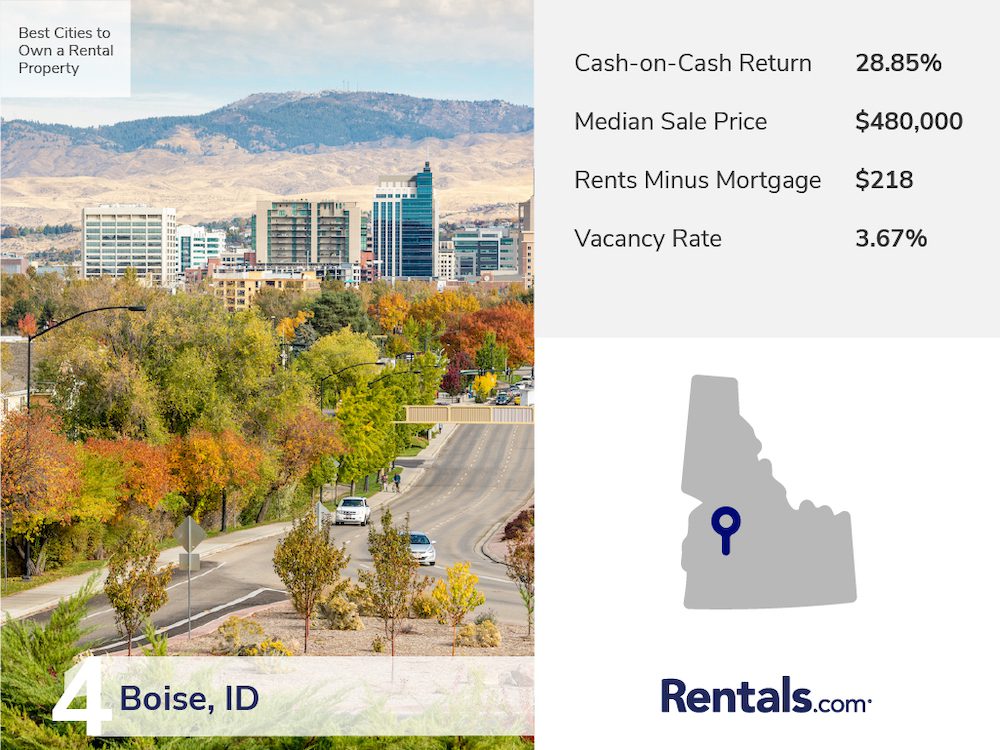

4. Boise, ID

Idaho's capital city is among the top 15 places to live, according to U.S. News & World Report. The town offers a good mix of urban, suburban and rural living, with plenty of activities for nature lovers. Its top-ranked schools and affordability attract renters, especially families.

Boise is one of the fastest-growing places in the country, and although it may be in the middle a real estate bubble, by the numbers it's one of the best cities for rental properties. Home prices are a little steep at $480,000, but you can earn $2,000 a month or $24,000 a year in rent. With expenses totaling $16,800, that's a great return.

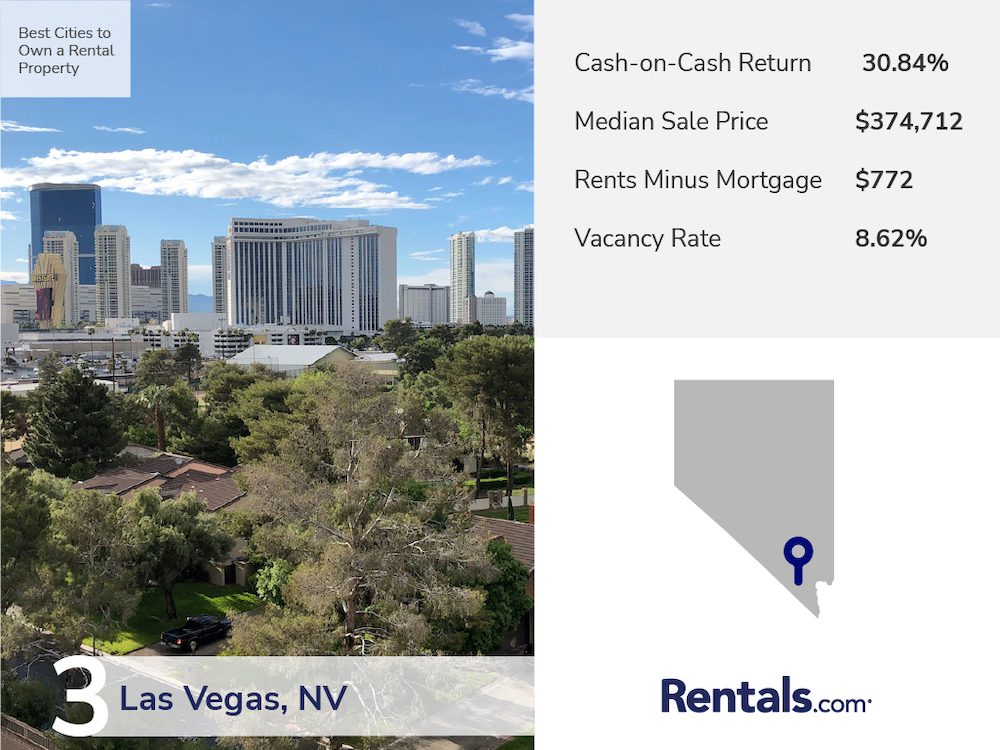

3. Las Vegas, NV

Casinos, bright lights and flashy shows likely come to mind when you think about Las Vegas. But Sin City is a great place to live, too. Beyond the Strip, there are plenty of suburban communities, top-rated schools, beautiful parks, cultural activities and more.

Buying rental property in Las Vegas is a lucrative investment. Homes cost about $374,700 and owning a rental home will cost about $18,900 a year, including mortgage payments and taxes. But, you'll be able to charge more than $2,100 a month, earning you $6,300 annually.

2. Phoenix, AZ

Arizona's capital city is known as the “Valley of the Sun" for its sunny year-round weather. The city is rich in history and culture, and residents enjoy a healthy job market and low cost of living. The Phoenix area is more than 200 square miles full of quiet suburbs and high-quality schools.

If you're thinking of investing in rental property, Phoenix is a great option. You can find plenty of homes for around $416,500 and rent them out for $2,300 or so a month. In a year, you'll earn $27,900 and just have to pay about $18,400 in expenses.

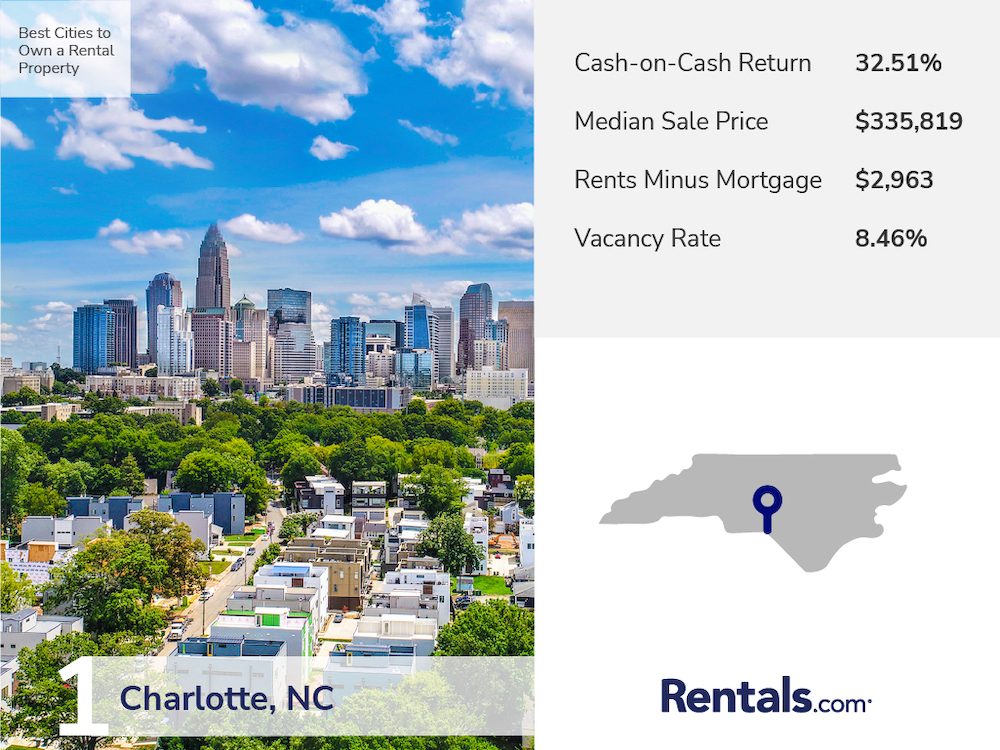

1. Charlotte, NC

There's a reason Charlotte tops our list of best cities for rental properties. It's one of the fastest-growing places and has earned a reputation for being a bustling tech city. And, that's drawn an influx of new residents looking for somewhere to live.

Home prices are reasonable. Many properties are available for $335,800 on average. Here's the best part — rentals go for $4,200 a month. That will bring in a whopping $50,800 year. With expenses at just $17,160, you can rake in more than $33,600 a year.

Tips for purchasing a rental property

Now that you know where to look for a rental property, here are several things to look for while house hunting:

- Choose the most desirable neighborhood. Areas close to universities and major employers, in top-notch school districts and near activities and amenities are some of the best places to buy rentals. Your vacancy rate will likely be low, which will keep your profits high.

- Pay attention to property taxes. While property taxes average $2,400 nationwide, they vary dramatically by city and neighborhood. Taxes are a major expense to factor into your bottom line.

- Check out the crime rate. Safety is a top consideration for renters, so make sure your property is in an area with a low crime rate. This will protect your investment, too.

- Research the local economy. Areas with a healthy job market and low unemployment rates will keep residents moving in and ensure you have a crop of renters.

- Look into average rent prices. Knowing how much similar homes in the area are renting for is crucial. How much you can charge for rent is a significant factor in determining your return on investment.

Location is the No. 1 factor when purchasing a rental home. Buying in one of these best cities for rental properties is a great investment. Your expenses will be low and your profits high.

Once you find a rental property, list it on Rentals.com to tap into a network of millions of home-seekers.

Methodology

To find the best places to own a rental property, we ranked metro areas based on the highest cash on cash return calculated using the following formula:

Cash on cash return = pre-tax cash flow / total cash invested

Where:

- Pre-tax cash flow = (median rent + appreciation) - (vacancy rate * median rent + expenses + mortgage)

- Total cash invested = down payment + expenses + property taxes

Data on median rental prices for single-family homes by metro were acquired from Redfin. Metros with fewer than 10 entries were not considered. Appreciation values were calculated based on Redfin's median sale price data for homes sold between 2015 and 2019.

Monthly mortgage payments were calculated based on Redfin's median sale price for the period ending September 30, 2021, assuming a 25 percent down payment on a 30-year fixed-rate mortgage. An interest rate of 2.98 percent was applied based on Freddie Mac's U.S. weekly interest rate average from November 10, 2021.

Data on property taxes, home values, expenses and vacancy rates represent the U.S. Census' 2019 American Community Survey 1-year estimates for metropolitan and micropolitan areas. The effective tax rate was calculated by dividing aggregate real estate taxes paid by aggregate home values. That rate was applied to the median sale price to calculate taxes owed. Final mortgage amounts are inclusive of taxes owed. Vacancy rates are exclusive of properties vacant for seasonal or recreational use.

All values are annual.

The price information included in this article is used for illustrative purposes only. The data contained herein do not constitute financial advice or a pricing guarantee for any home or rental property.